are funeral expenses tax deductible on 1041

This means that you cannot deduct the cost of a funeral from your individual tax returns. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

Are Funeral And Cremation Expenses Tax Deductible National Cremation

What funeral expenses are deductible on estate tax return.

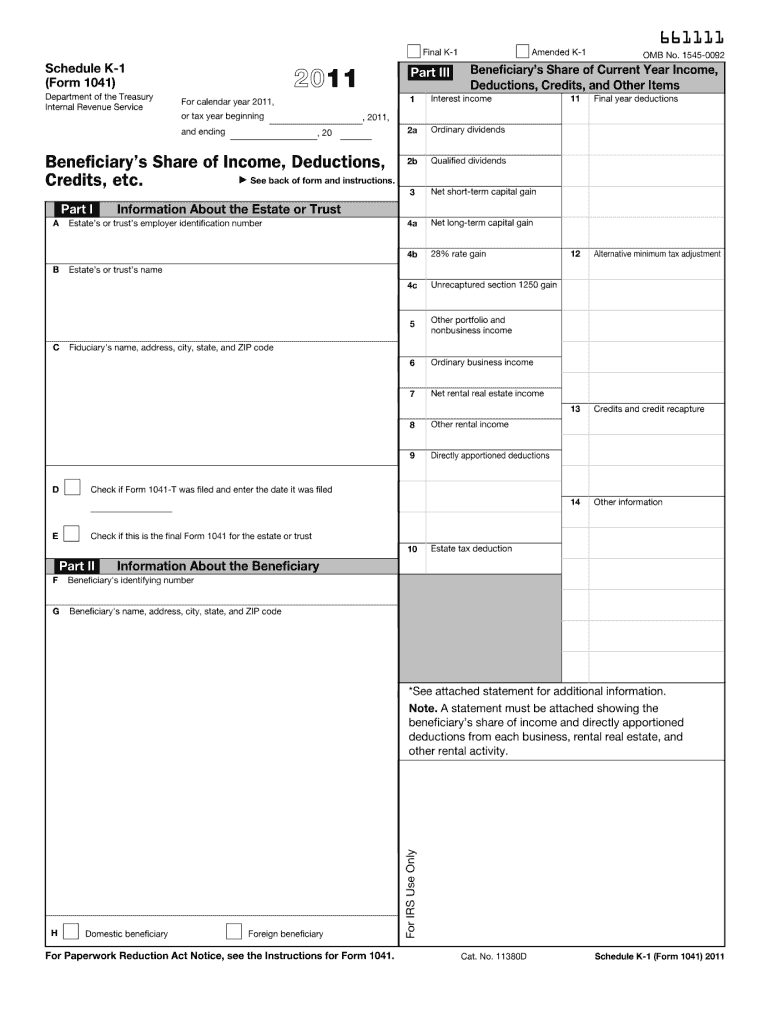

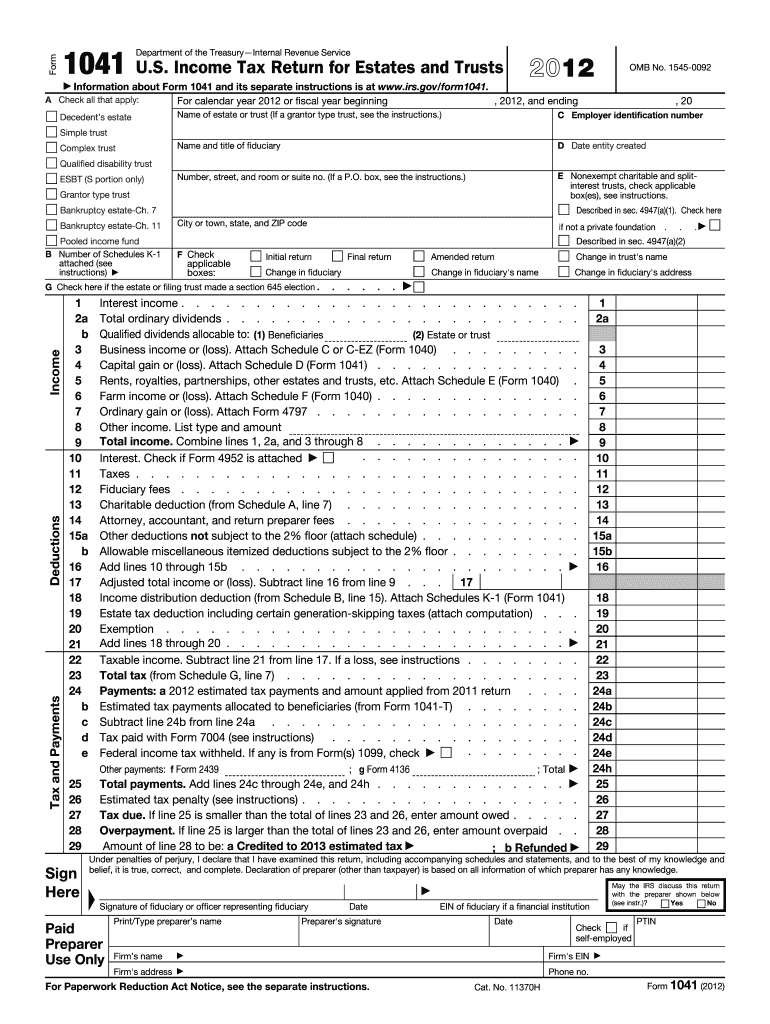

. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a. Schedule J of this form is for funeral expenses. Individual taxpayers cannot deduct funeral expenses on their tax return.

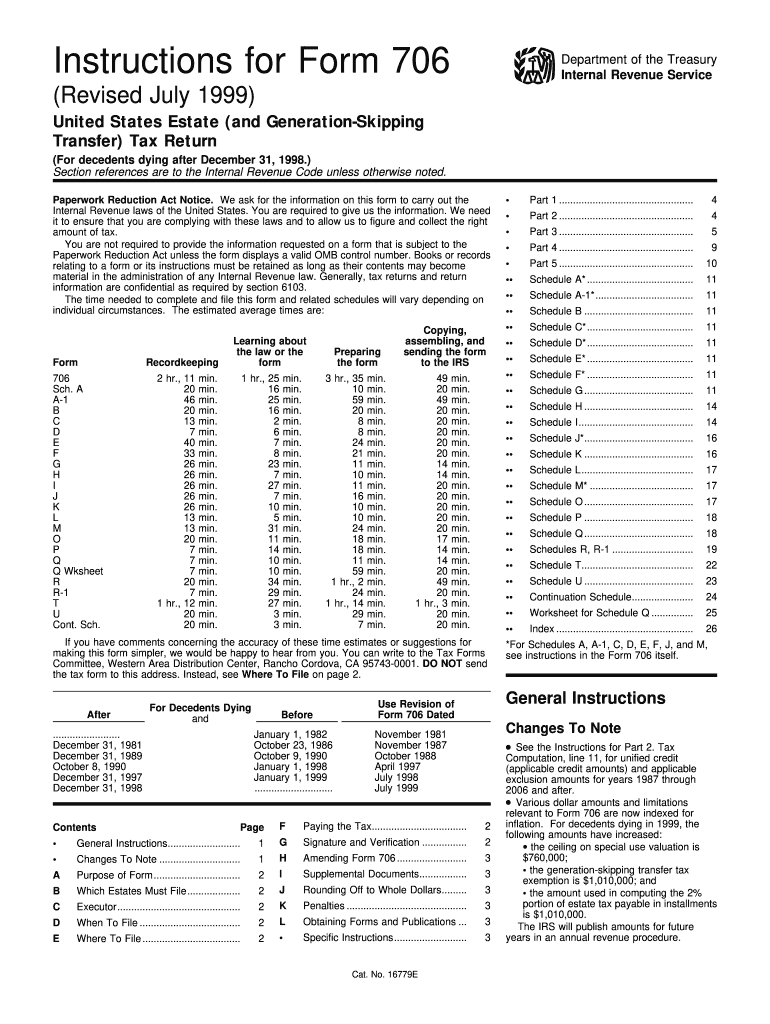

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form. Where can a decedents funeral expenses be deducted. But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving.

This is due within nine months of the deceased persons. Are funeral expenses deductible on 1041. 1041 Federal Taxes Other Deductions I am working on my fathers estate using TurboTax Business.

He passed away in Aug 2019 and this is a non-final return. These are personal expenses and cannot be. Are funeral expenses deductible on 1041.

Estate income is reported on Form 1041 and this form allows your executor to claim your. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or. If such income exceeds 600 for the year your estate must pay income tax as well and this is separate from Form 706 the estate tax return.

Rent utility bills and funeral of the decendent so that the beneficiaries. The routine type of deductions are mostly self-explanatory see screenshot. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. IRS rules dictate that all estates worth. They may be deducted for estate tax purposes on either a Federal or State estate tax return.

On Form 1041 you can claim deductions for expenses such as attorney accountant and return preparer fees. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Can I deduct funeral expenses probate fees or fees to administer the estate.

The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are. You cant take the deductions. Are funeral expenses deductible on 1041.

Are funeral expenses tax deductible CRA. Funeral expenses are not deductible for income tax purposes. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

For this reason most cant claim tax deductions. These need to be an itemized list so be sure to track all expenses. Estate income is reported on Form.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents. Individual taxpayers cannot deduct funeral expenses on their tax return. While the IRS allows deductions for medical expenses funeral costs are not included.

Many estates do not actually use. Hi is there anywhere on the 1041 to deduct the final living expenses ie. However funeral expenses are simply not deductible on Form 1041 and brokers fees incurred.

Is The Travel Expense Tax Deductible For The Death Of A Parent Abroad

Form 1041 Qft U S Income Tax Return For Qualified Funeral Trusts

All About Irs Form 1041 Smartasset

Irs Instruction 706 1999 Fill Out Tax Template Online Us Legal Forms

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Form 1041 Qft U S Income Tax Return For Qualified Funeral Trusts

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Probate Fees Tax Deductible Trust Will

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Funeral Expenses Tax Deductions

Tackling Tax Issues As An Estate Executor Hantzmon Wiebel Cpa And Advisory Services

Irs 1041 2012 Fill Out Tax Template Online Us Legal Forms

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)

:max_bytes(150000):strip_icc()/GettyImages-518860674-02055f25a0cb4ea1806ca545f86f9d5f.jpg)